How long will the elephant be in the room? The magnitude of global inflation is raising this question for the leading producers of crude oil all around the world. Both Brent and WTI Crude have shown huge volatility in the last year within the range of 70-85 $/barrel levels as shown in the chart below.

Crude oil is an essential raw material for most of the countries. Hence, rising crude oil prices means rising the prices of producing and transporting goods that increases the overall cost of the goods leading to inflation.

Due to the continuous rise of crude oil, inflation is at an all-time high in the US where it touched 6.8% in November year-on-year (Y-O-Y) rate. According to the CPI (Consumer Price Index) numbers released, the same rate was 6.2% in October.

Similarly in India, we saw an increase in inflation from 4.48% in October Y-O-Y to 4.91% Y-O-Y in November, according to the Ministry of Statistics and Programme Implementation (MOSPI, GOI). Other than that, countries like the UK, China and Germany have also reported higher inflation numbers in the last few weeks.

What is Crude Oil? Who are the major producers and consumers of Crude Oil?

Crude oil, also known as petroleum, is a naturally occurring yellowish black liquid found beneath the earth’s surface. Petroleum is mostly recovered by oil drilling and once extracted, the oil is refined and separated into numerous products of direct use such as gasoline (petrol), diesel, kerosene, plastics, pesticides, etc.

Some of the major producer-countries are the United States, Saudi Arabia, Russia, Canada, China, Iraq, UAE, etc while top consumers are the United States, China, India, Japan, Russia, Saudi Arabia, etc. The world demand of crude oil is nearly 100 million barrels (1 barrel is close to 160 litres of oil ) per day.

The price of oil is a major factor in the overall economy, as it is mostly traded globally and is imported by the majority of the consumer countries. India is a net importer of crude oil, as it imports 82% of its total oil needs (around 205 million tonnes in 2019) that estimates a foreign outflow of 63 billion US $ in 2019.

What is Brent and WTI Crude Oil?

General crude oil is dominated by two indices Brent Crude Oil (originating from oil fields in the North Sea near Norway), while WTI (West Texas Intermediate) is sourced from the US oil fields.

Brent Crude is priced mostly as a benchmark of crude oil and is akin to two-thirds of all oil pricing. WTI is slightly lower in price than Brent oil especially after the American Shale Revolution that increased the production of oil in the US.

What is OPEC?

OPEC is an abbreviation of Organization of the Petroleum Exporting Countries. Formed in 1960, OPEC is a permanent intergovernmental organisation of 13 oil exporting developing nations that coordinate and unify the petroleum policies of its member countries. Its headquarters is in Vienna, Austria.

Member countries of OPEC are Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, UAE, and Venezuela.

Objective of the formation of OPEC is to secure fair and stable prices for petroleum producers, an efficient economic and regular supply of petroleum to all the consuming nations and a fair return of capital to those investing in the industry.

OPEC uses Brent Oil as their pricing benchmark and their policies are made around Brent Oil.

Why are crude oil prices dwindling and what happened in the COVID-19 period?

Once the COVID-19 pandemic hit the globe, there were lockdowns and restrictions imposed that brought travel bans. This brought down the demand for crude oil instantly. Hence we saw financial markets going down and that led to crude oil price crash.

In March 2020, worldwide oil demand fell rapidly as governments closed businesses and restricted travel due to the pandemic. Later, in March, Russia and Saudi Arabia failed to reach a consensus in oil production levels. In April, an oversupply of oil led to a steep collapse in oil prices where WTI crude went down to 18$ per barrel.

OPEC and its allies agreed in the spring of 2020 to cumulatively cut nearly 10 million barrels per day of crude production in a historic step, as it faced a pandemic-induced crash in oil prices. The alliance then settled down the cuts to about 5.8 million b/d.

What is global demand and supply scenario right now?

To compensate for the supply cut initiated from last year, OPEC decided to raise the output by 0.4 million barrels/day till the next few months for the rise in demand. In the last meeting, it was decided that this increase will continue till next January.

After the demand started reversing, supply had to match so that the prices also started recovering. But who can predict an environmental crisis in between? The hurricane Ida appeared that halted a lot of refining operations in the US. Now, countries such as the US and India urged OPEC to raise the output frequently due to the foreseen supply crunch and the swell in inflation. Initially, OPEC’s view in this was to stay put with the initial output raise as the fourth wave of COVID-19 was being anticipated.

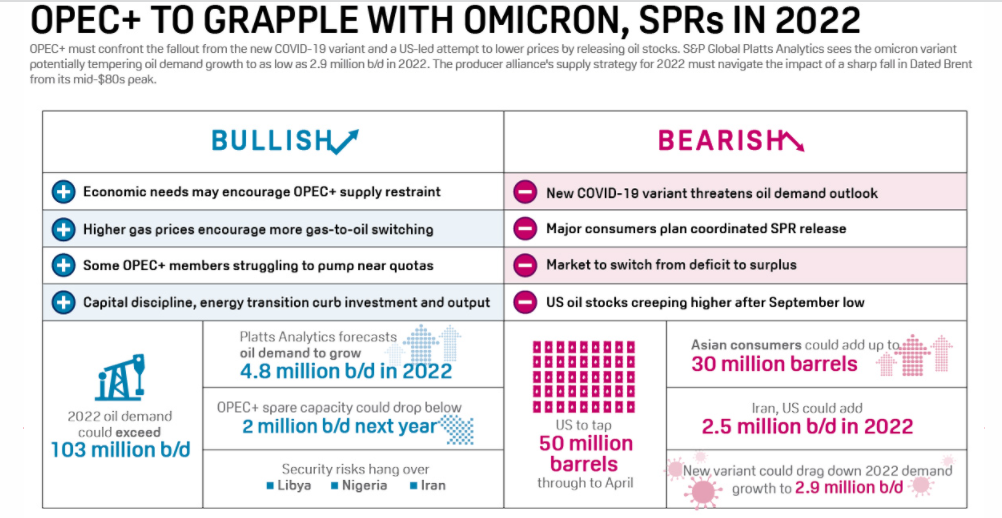

In the midst of all this, global demand started dwindling, as the new strain of COVID known as ‘Omicron’ originated in South Africa. Now, the biggest concern here is that if it is going to impact the markets the same way like it did last year, prices may drop again due to supply glut.

What is SPR and how is it expected to change the supply scenario?

Strategic Petroleum Reserve (SPR) is an emergency stock kept with few countries to be used under emergency situations like wars or shutdown resulting in an energy crisis. A stockpile of crude is maintained to curb the short-term supply disruptions by the respective governments and private firms of few countries.

This is why the International Energy Agency (IEA) and its 30 member countries must have strategic petroleum reserves. Besides the US, 29 other countries like China, Germany, Japan, Australia, UK and India hold emergency stocks with them. The idea here is to keep reserves equivalent to 90 days of net imports.

In the current situation, the US is expected to release 50 million barrels from the SPR. Out of this, 30-35 million barrels will be exchanged in the next few months and 18 million barrels were to be released by December 17. Total SPR stocks in the US stand at 604.5 million barrels as of now.

India also has plans to release 5 million barrels of crude oil from the SPR out of the 38 million barrels of its total capacity. This volume is equivalent to per day consumption of crude oil in India. Japan, China, South Korea and the UK would bring 65-70 million barrels per day. The pace of release is not defined yet. This supply is expected to curb the crunch.

What are the future expectations for Crude Oil prices?

Crude oil prices right now depend on the demand structure going ahead, due to the huge transmissibility of Omicron Variant of COVID-19. Given the pace with which this variant is spreading and the continuous warnings by the WHO, crude oil price movement is expected to be highly volatile going ahead.

“If this is another wave like the ones we have seen before, then it is a negative hit to economic growth in the first quarter of 2022,” said Damien Courvalin, head of energy research at Goldman Sachs. “But if there is a subsequent recovery, oil demand, which briefly touched pre-COVID levels in early November, would then be at new record highs for most of 2022.”

He further said that there would need a ‘wait-and-watch’ policy for the wave to pass with the hope that international travel should recover next year. This would hint at the oil prices being about $85 per barrel in 2022.

Massive economies like the US are facing inflationary pressure due to this and are keen towards reducing the crude oil prices. Hence, SPR release will be an important factor to be seen in future. Also, it is important to factor in the US-Iran talks where it is to be decided if the sanctions will stay.

To sum up, Crude oil market has multiple factors for future price movement. The Omicron’s trajectory, the OPEC stand, the US crude oil stocks as well as the SPR release will all impact everyday markets going ahead. So far, prices are in the range of 70-80$/barrel for WTI and Brent Crude Oil.

Edited by: Aparna Nair