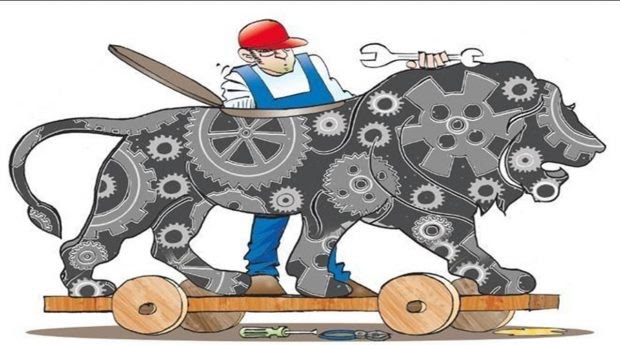

In a bid to bolster economic recovery in pandemic times, the federal government in Budget 2022-23, proposed the plan to scale up capital expenditure to historic highs. The capex allocation has been increased by a whooping 35% from the previous year to 7.5 lakh crore. The capex booster is expected to compliment infrastructure development across sectors, domestic demand, and spur rural growth.

Capital expenditure is essentially the money spent by the government on the diversified infrastructure development. It also includes the cost incurred on acquiring fixed assets like land and investment by the government that returns profit in future.

The incremental funds announced in the budget, are expected to be injected in diverse areas. “The major sectors where capital expenditure push will come are on highways, railways, telecommunication and defense capital expenditure, in particular domestic defense procurement”, said Dr. TV Somanathan, Secretary, Department of Expenditure.

He further clarified that government is also earmarking a sum of 1 lakh crore rupees to be lent to state governments as interest-free 50-year loans which will be incurred by them on capital expenditure. The move is oriented to cover revenue crunch being repeatedly reported by state governments in context of fulfilling their share of financial commitment to respective projects. Focus will also be given to border roads, village connectivity, affordable housing, broadening of roadways and potable water supply mechanism.

Rajiv Kumar, Vice Chairman NITI Aayog lauded the move in a social media post. He tweeted “With CAPEX target expanded significantly by 35.4% – ₹5.54L Cr. to ₹7.50L Cr. & FY23 effective CAPEX seen at ₹10.7L Cr. – #Budget2022 lays a robust foundation for the generation of employment opportunities, enhancing of incomes & greater growth prospects overall.”

Economist Shamika Ravi shed light on economic prudence of increasing budgetary allocation on capex. “Why pump up capital expenditure while restraining revenue expenditure? Because Indian fiscal data shows that capital expenditure has multiplier of ~2.5 while revenue expenditure has less than 1”, she tweeted.

Finance minister Nirmala Sitharaman added in her speech that a higher capital expenditure outlay will be 2.9% of India’s gross domestic product. In a bid to part-finance the budget deficit, New Delhi now looks ahead to ambitiously borrow 15 trillion rupees (roughly $200 billion) next financial year.

While plans for ambitious borrowing for ambitious spending were laid out, fiscal consolidation too wasn’t ignored. While presenting her fourth national budget in parliament, Sitharaman stated that the nation’s fiscal deficit is expected to shrink to 6.4% of gross domestic product (GDP) in the following financial year beginning Apr. 1.

“I am conscious of the need to nurture growth, through public investment, to become stronger and sustainable,” the finance minister commented while mentioning to the deficit level for 2022-23.

Earlier on Tuesday, Nirmala Sitharaman laid out an expansionary 39.45 trillion-rupee budget with higher outlays for farm and infrastructure sectors.

Budget 2022-23 also advanced upon a green energy plan to roll out a battery swapping policy for faster adoption of electric vehicles and additional incentives to make high-efficiency solar panels.

“The private sector will be encouraged to develop sustainable and innovative business models for battery or energy as a service. This will improve efficiency in the EV ecosystem,” the minister said.

New Delhi, last year, had sanctioned PLI scheme for advanced chemistry cell battery storage with a total outlay of $2.4 billion.

The finance minister also announced the launch of sovereign green bonds scheme as a part of government’s market borrowing for the next financial year. The proceeds garnered from this range of debt issuance will be deployed in public-sector green projects, she added.

However a 30% tax on any income from transfer of digital assets took many by surprise. Industry experts remain divided over the move.

Edited by NK Jha