Global commodity prices are on a 50-year high, and crude oil is rallying like never before. Russian invasion over Ukraine has led to a disruption in global supply mechanisms, and economists have cautioned the global order to prepare for inflationary shocks. According to UK’s National Institute for Social and Economic Research the current crisis can knock off 1$ trillion from the global economy and add 3% to global inflation.

Amidst all the buzz about soaring rate of Inflation, The Voices explains the basics idea of inflation and the shades of contemporary discourse around the same.

What is Inflation?

Inflation, primarily, is rise in prices of goods and services in a period of time or it is reduction in the purchasing power of a currency in a certain period. Increase in the supply of money, which triggers demand, is at times the root cause of inflation and is known as Demand-pull inflation. The major supply side disruption or increase in cost of intermediate goods in prodcution chain, which pushes the production cost, is the other cardinal force behind inflationary shocks. Such inflationary shocks are categorized as cost-push inflation. Other prominent category of inflation is built-in inflation wherein the expectations of production force about future rise in inflation makes them to demand higher wages which result in increase in cost of basket of goods.

How Inflation is measured?

Inflation is measured primarily by CPI (Consumer Price Index) or WPI (Wholesale Price Index). Consumer Price Index is a metric that estimates the retail price rise in a basket of goods, which is of primary need to a consumer base. Differenent of the basket are assigned a particular weight (i.e share) and the price rise is measured in relation to a preassigned price. In India, Ministry of Statistics and Programme Implementation measures the retail Inflation of the country every month by calculating the price of a basket of commodities. WPI is measured to understand the rise in prices of goods and services sold in bulk or wholesale business.

Both the indices take account of rural and urban prices separately and in a combined sense for a detailed understanding of the Inflation.

What are the components of CPI and WPI?

| CPI | WPI | ||

| Components | % Share | Components | % Share |

| 1)Food and Beverages | 54.18% | 1)Primary Articles | 22.62% |

| 2)Pan, tobacco etc | 3.26% | Food Articles | 15.26% |

| 3)Clothing and footwear | 7.36% | Non Food Articles | 4.12% |

| 4)Housing | 0% | Minerals | 0.83% |

| 5)Fuel and Light | 7.94% | 2)Crude Petroleum &NG | 2.41% |

| 6)Miscellaneous | 27.26% | 3)Fuel and Power | 13.20% |

| |

|

4)Manufactured Products | 64.20% |

*Overall CPI with its components, Source:MOSPI

For CPI, the data applicable to consumers are collected from various consumer markets, while for WPI prices are collected at ex-factory level for manufactured products, at ex-mine level for mineral products and mandi level for agricultural products.

The miscellaneous component of CPI includes sectors such as education, transportation, healthcare etc. As WPI does not include these parameters, CPI is considered more advanced and is closely monitored by the central banks.

How food Inflation is calculated?

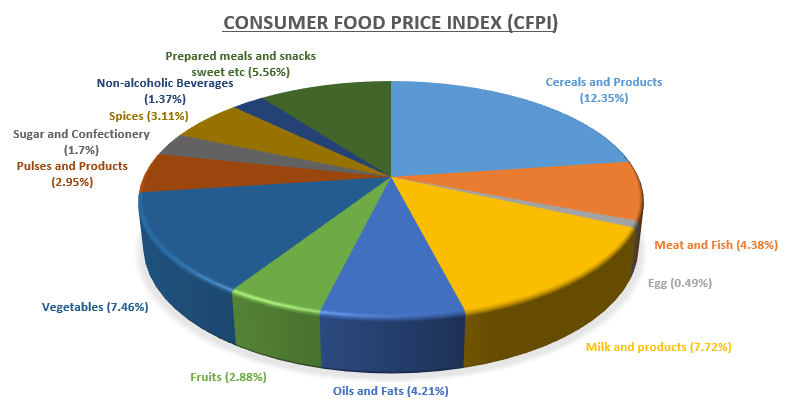

CFPI (Consumer Food Price Inflation) measures the change in retail prices of food items consumed by the people. It is calculated on annual and monthly basis for rural and urban profile in India.

*CFPI with the share of its components (India), Source:MOSPI

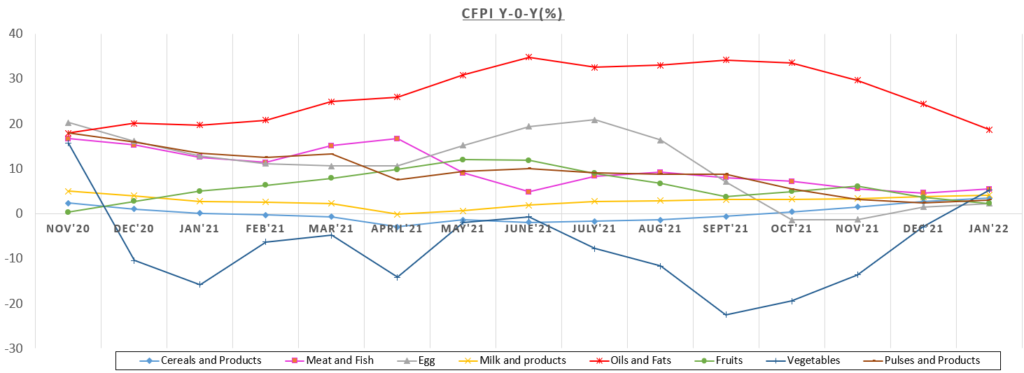

What has been the trend of CFPI in last few months?

* Overall CFPI with its components, Source:MOSPI

In India, Food Inflation in last few years has been very volatile due to the continuous increase in prices of the intermediate goods. As per the latest CFPI estimates, all the components barring oil are witnessing a single digit inflation. Inflation in oil prices hovers around 20% mark.

Suresh Naranayan, Managing Director – Nestle India, says, “If the food inflation continues for a long time, then it can be a cause of concern.” With Russia, a key global supplier of agricultural nutrients, being engaged in war, the supply side upsets may further augment the rise of food commodities. Interestingly, Ukraine too supplies 70% of India’s sunflower oil requirement and the ongoing war will have obvious implications.

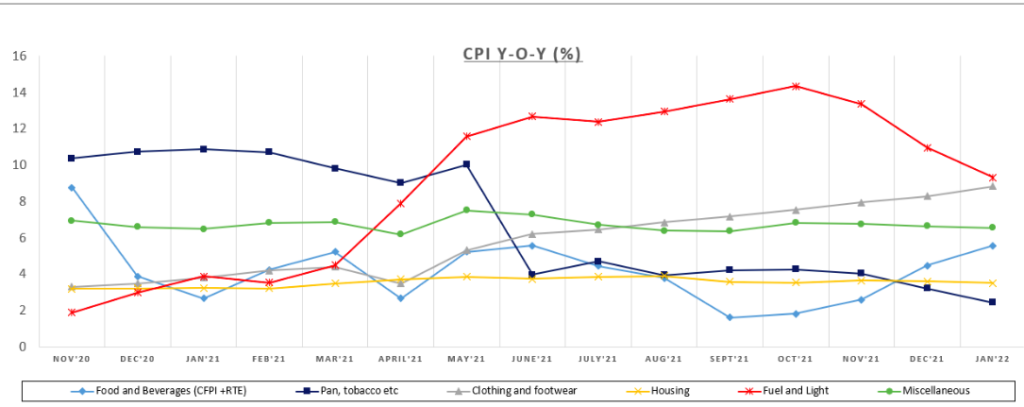

The recent most Inflation trends

* Overall CPI with its components, Source:MOSPI

CPI surge is driven by unprecedented rallying in energy prices around the globe, which are expected to further rise due to supply side disruption driven by Russia-Ukraine conflict. Before the crisis, oil prices were trading around 70-75$ per barrel, which now stands around a decade high of 110$ per barrel.

Pandemic disrupted supply chains as production witnessed slowdown, and demand plateaued. This excited the first wave of inflation surge. Then economic incentives from states and pandemic times adjustments scripted a story of revival. But now, for a global economic order recovering from pandemic times standstill economic shocks, and an Indian economic paradigm infused with post recovery optimism driven by a little surge in demand, the military conflict can be a game changer. JP Morgan Chase and Co. has predicted that the oil prices may further rise up to 150$ per barrel and may induce global inflation of 7% and above.

In India, owing to the 14 months high CFPI, CPI crossed the RBI’s standard limit of 2-6% inflation in January this year. RBI in its last MPC meeting had projected CPI inflation to reach up to 5.7% in the March’22 quarter and further reduce to 4.5% in June’22 quarter. But the military conflict will certainly inspire recalculations. On Thursday, RBI announced the next round of household survey to capture Inflation trends.

General measures to contain Inflation

Money supply tweaks are often deployed to control Inflation. Higher interest rates charged by banks, reduces the credit flow which can pacify the inflationary pressure. On fiscal policy front, higher taxation too contains the demand driven inflationary shocks as it reduces the spending. Production based incentives to select sectors and rationalization of wages too may be considered. But then deploying any one of these measures calls a lot of other economic factors into consideration.

(*This article is meant for basic understanding of Inflation. The complexities of economic situations demand subject specific expertise and interpretation of the concept accordingly.)

Edited by NK Jha